The inflation rate reported at the end of January 2022, was 4.8%. Reports say this is the highest it has been in more than 30 years. However, this is not a true indication of inflation across the board because the increase in house price, for instance, is not factored in this percentage.

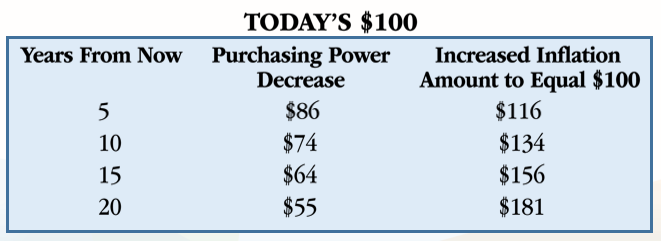

As mentioned in a previous blog on inflation, it is the silent killer that eats away at your money and reduces your buying power over the years. The chart below shows how an inflation rate of 3% affects your purchasing power of $100 over a 20 year period.

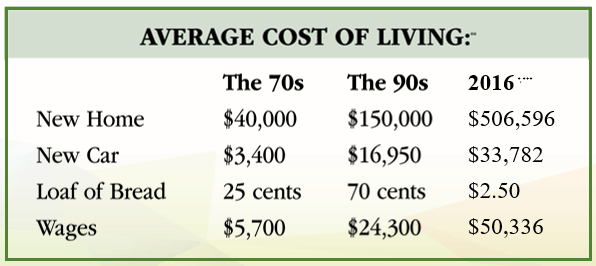

The chart below shows how an inflation rate of 3% affects the average cost of living from the 1970s to 2016.

Now that inflation has hit 4.8% you can imagine how this will affect the average cost of living for the next 40 years if this trend continues.

And the million-dollar question is: Is your income increasing to keep up with the increasing rate of inflation?

The Bank of Canada does not include the hike in house price in the rate of inflation, and I do wonder why this is, when owning a home is the main goal for many Canadians.

Could it be that the rate of inflation would be significantly higher?

Here’s an example of the increase in house price over the past 20 years.

In 2002 I purchased a townhome in Markham Ontario for $250K. That home is now valued at $1.2M. What is the percentage increase over the 20 years?

- Difference in value is $1,200,000 – $250,000 = $950,000

- Percent increase = 950,000/250,000 x 100 = 380%

- If you divide 380 by 20 to get the average percent increase per year, you’ll get: 380/20 =19

So the value of the home has increased by 19% on average every year over the past 20 years. And do keep in mind that for about 18 of that 20 year period, the average rate of inflation was 3% or less.

Now if I’m using compound interest:

250,000(1.081589)^20 = 1,200,011.05

So the value of the home was compounding at about 8.16% per year.

Suppose we compound the current value of this home, $1.2M, at the same 8% per year for the next 38 years to the year 2060. What will be the value of the home then?

House Value = 1,200,000(1.08)^38

= $22,350,330.76

Can you imagine a townhome being worth $22,350,330.76? What income would a person have to be getting to be able to afford purchasing a townhome in 2060 at that cost?

I know that past performance does not predict future performance, but I suspect that at a higher rate of inflation that is adversely affecting building materials and construction costs, the average yearly increase in house price may not be much different going forward.

So what’s the lesson here? Having only a single job may not be sufficient to help the next generation to own a home. They will need multiple streams of income!