What is Inflation?

I do like Investopedia’s definition of inflation: It is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time.

But my simple definition of inflation is the increasing reduction in the amount of goods and services that I can purchase for $100 each year, so there is a rise in prices of goods and services over time. And if I should simplify even more I would say: inflation is that which causes me to leave the food store with only 2 bags of goodies now, when 5 years ago I could leave with 4 bags of the same goodies for the same cost.

When things seem tighter and tighter people often tend to blame themselves for not getting a better job to earn more money, or for not saving enough to have more abundance. They sometimes take on another job or 2 which builds on their already crazy schedule, taking more time away from their families, and yet it often feels that there’s not much change in their situation.

In fact, many times it becomes even more frustrating because you’re busting your tail to make ends meet, but just when you think you’re making some headway, life throws a curveball at you that strikes you out at home plate. It just never seems fair that you’re putting in way more but the reward is not significant. But why?

There are 2 things that is responsible for the feeling of the lack of correlation between putting in more effort and getting out more money:

- Taxes

- Inflation

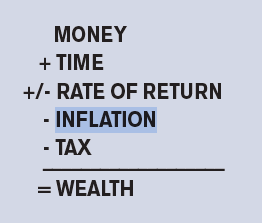

The taxman is always in your pocket ciphering off your money while Mr. Inflation keeps reducing the value of each dollar to ensure that the rate at which you build wealth will be impacted and thus chart a slower course. Let’s look at the Wealth Formula:

Like the taxes you pay, inflation is expressed as a percentage and must be subtracted from any earnings you receive to determine the true value of your wealth. It was reported that the annual inflation rate in Canada in April 2021 was 3.4% which is more than a 1% increase from April 2020. But do keep in mind that these percentages represent the average because the said news item reported that some goods and services increased more than 9% over a 2 month period.

To disguise the effect of inflation, some companies try to pull the wool over your eyes by keeping the prices close to the same but reducing the amount of content in a package. Start paying attention to the size or content of some items and you will definitely see the effect. I’ve compared older and newer items in my cupboards and see the obvious reduction in size and content.

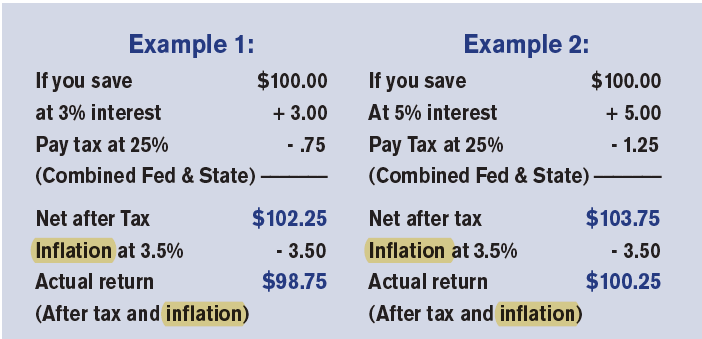

To see the true impact of inflation on your money, let’s look at 2 examples that use an inflation rate of 3%.

It is evident from example #1 that if the perceived rate of return on your money is only 3%, you’re actually losing. Example #2 shows some winnings but rather insignificant considering that the perceived rate of return is 5%. Still, whether the winnings are large or small, it’s always better to win than lose. Hence if you want to beat the taxman and Mr. Inflation, the investment on your money should be at least 5%. And do keep in mind that this calculation was at an inflation rate of 3% — 0.4% lower than the 3.4% reported in April.

Do you think the inflation rate will increase or decrease by the end of 2021?

I’ll share some information and then let you decide for yourself.

Inflation usually occurs when a country prints more money than it earns. This causes everyone to lose some value of their money because it’s like a hidden tax. Right now the government is practically printing all the money that they are using to sustain the relief benefit for families who are impacted by the pandemic.

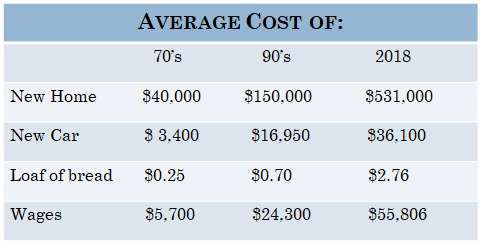

Let’s also look at the prices of some basic things over time:

In April 2021, the average cost of a new home in Canada was $695,657. Next time you go to the food store you can check out the price for the cheapest loaf of bread, and do keep in mind that the prices in the table show the average.

I’ll implore you to check out the average price for the other items in the table, but I suspect you already have an answer to my question about inflation increasing or decreasing by year end.

Now that you’re more aware of the impact of inflation, on your spending power, the value of your money and your wealth, it’s time to identify strategies to protect your money against this silent killer to preserve your wealth. Do connect with me so that I can share some strategies with you.