Build A Strong Financial House

A well built home can last for many years if it has a strong solid foundation, and subsequent levels are built with the appropriate strength to withstand the higher levels. If the home is not built correctly however, it can fall apart very quickly because it cannot withstand nature’s elements or catastrophes. The same strategies used to build a solid long lasting home are necessary and should be utilized when you’re building your financial house.

Have you ever watched the stages of a high-rise building being built? For months you may see activities but a huge hole of nothingness then one day that hole is filled with evidence of a building coming to life. Perhaps you had purchased a condominium unit on the 35th floor and drove past the location of your new home regularly, wondering when they would be finished, even thinking that they may not be able to honour the move-in date that they promised you.

Even after the building is past the earth’s surface you’re not convinced you can move in as planned because it took so long to get to the first floor. But a few months later you became more hopeful because the floors seem to be going up at lightning speed. A question that may have crossed your mind was: What changed, why are they going so much faster now; it is not like the weather wasn’t always good?

The answer to that question is: It takes a much longer time to build a strong foundation for the condo that will not only withstand the weight of every floor so the condo doesn’t collapse on itself, it has to be able to withstand the storms, tornados and hurricanes that may occur through the years.

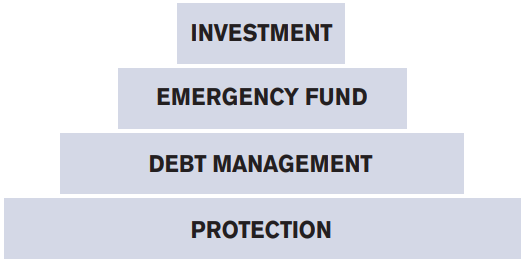

This is exactly what you have to do if you want to have a strong financial foundation — build your financial house in the proper order! The first floor of the condo could not be built before the foundation so build your financial house in the correct way!

But what is the correct design for a strong financial house you may be asking?

Many people build their financial house grossly incorrect! Why?

Because they don’t realize that they (or the person bringing in the income) are their greatest asset so the first stage of building is to protect the greatest asset!

And how do you protect your greatest asset? Insurance protection!

This is why protection is at the foundation of a proper financial house. Protect your greatest asset against sickness, disability and unexpected death — in the case of death, you’re protecting your loved ones even from the grave.

Proper protection can be achieved in 2 ways:

- Attaining Financial Freedom (having enough money to cover you and your family if you’re ill or if you die)

- Buying Insurance Protection (Life, Critical Illness, Disability)

Below are a few examples of how most people build their financial house.

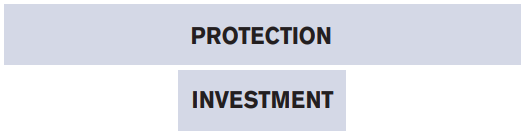

Example #1: For those who decide to go into debt first and believe insurance is for later in life, their house may look like this.

Example #2: For those who don’t have debt but believe that insurance is for later in life, their house may look like this.

Example #3: For those who don’t think they need insurance and investment is more important, their house may look like this.

Notice “Emergency Fund” is missing from the variants of the financial house design? This is because most people do not have an emergency fund. And this is why many people are in debt. Any unexpected large expense sends them running to their credit card, line of credit, or both, which often have revolving balances already.

And what many credit card users don’t realize is that once there’s a revolving balance on their credit card, there is NO grace period. So even if they plan to pay the balance in full by the due date — and usually they can’t which is why they have a revolving balance — interest is charged on that new purchase at a daily rate. And it’s compound interest….not simple interest!

So the takeaway here is that for a strong financial foundation, your financial house should be designed according to the first diagram above, the proper order being: Proper protection, Debt Management, Emergency Fund, Investments.

Do keep in mind that emergency fund and investment are not the same. Investment is for the long term while emergency fund is for the short term. As the name suggests: ‘Emergency Fund’ is a fund for when an emergency occurs.

If your financial house is not designed properly, it’s not too late. But you shouldn’t procrastinate….you should start redesigning it now!

And if you need help to achieve the proper design — and put your financial house in the right order — I can certainly help you to do so.

And now that you know the right way to build a solid financial foundation….do share it with your loved ones so that they too can achieve financial security.