One major concern that many parents have these days is that their children may not be able to afford purchasing a home because of the high cost of living and the high prices of homes. Some parents are delighted that their children are able to land a job while they are studying, but they are equally concerned that their children are either not putting the money to good use now, or they don’t have many options to put their money to good use to benefit them in the future.

A conversation with a parent as to where his daughter could put even $100 of her monthly income led me to explain the benefits of a Universal Life Insurance and how purchasing this would create far more benefit for her in the future than just putting it in a savings account.

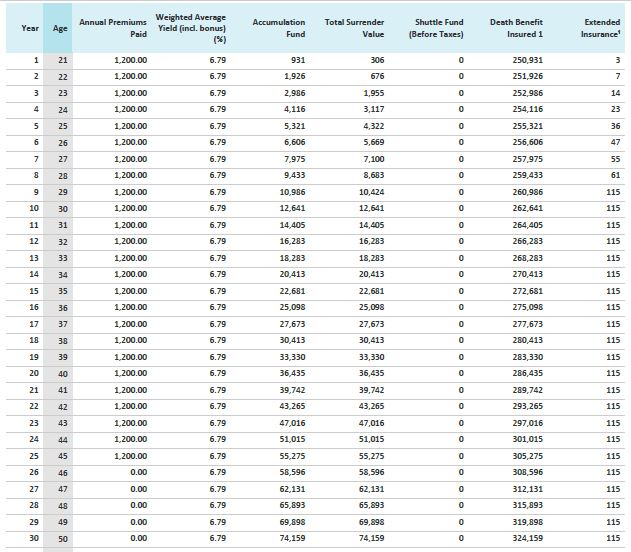

The clip of the illustration shown below is based on the following information:

- 20 year old female

- Non-smoker

- 25-year pay

- Face Value is $250K (Initial Death Benefit)

- Premium: $100 per month ($1200 per year)

From the illustration for the first 30 years you will see the following:

- After age 45, the annual premium is $0

- The cash surrender value at age 45 is $55,275

- The death benefit keeps increasing every year

- At age 45 the death benefit is $305,275

So, if the daughter wishes to surrender the policy at age 45, she will get the cash surrender value, which could help towards the down payment towards a home, to purchase a new car, to start a new business, or it could fund other expenses.

However, the daughter wouldn’t have to surrender the policy to get access to some of the funds from the cash value. She could borrow some money from the policy and repay it after. Hence, if she’s in need of some funds, she wouldn’t need to apply for a loan which would affect her credit score, she could just take a policy loan.

The beauty of a policy loan is that it wouldn’t show up on her credit profile so to other creditors, it would be like she doesn’t have a loan.

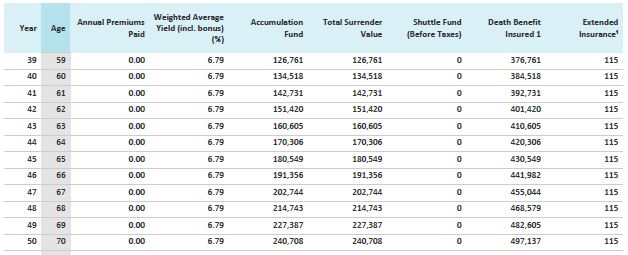

From the part of the illustration shown below — from age 59 to 70 years — you will see that if the daughter leaves the policy intact and surrenders it at age 65 instead to help with retirement income, the cash value at age 65 would be $180,549.

That is more than 300% of what the cash value was at age 45.

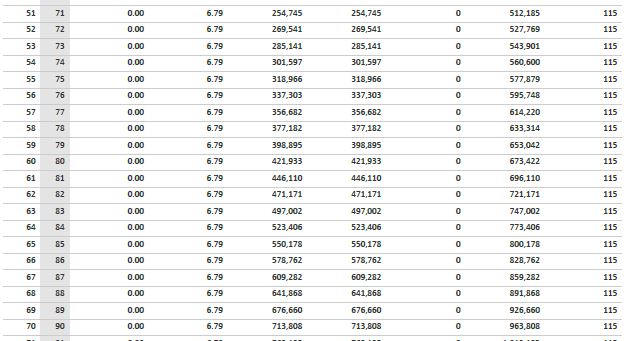

Now let’s suppose the daughter doesn’t cash the policy, but leaves it for a legacy for her children. If she dies at age 88 — the average lifespan of a female non-smoker — from the part of the illustration shown below, you will see that her beneficiaries will get the death benefit of $891,868 tax-free!

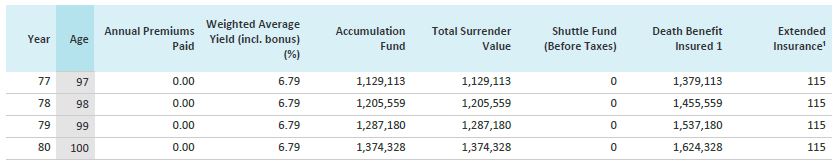

And if she dies at age 100 instead — the age at which insurance is usually endowed — her beneficiaries will get a whopping death benefit of 1,624,328 tax-free! as shown below.

Surely you will admit that both amounts are definitely a sizable sum of funds that could change the trajectory for the next generation.

Now just imagine that the daughter teaches her children to do the same, and her children do the same for their children and so on. Wouldn’t creating generational wealth become a domino effect?

Knowing this, if you were that father, what would you do now?😂