Most people have a love-hate relationship with their credit cards!

They love their cards whenever they want to make immediate purchases that they do not have the funds to cover such as purchasing a new furnace when their furnace died unexpectedly, or paying for a vacation that they cannot afford at the time of travel, but plan to pay for it overtime.

They also love that their cards accumulate reward points that can be redeemed to purchase gift cards, book flights, get cashback on their credit card bills and so on. However, their emotions quickly shift from love to hate when they see the debt that accumulates, often within a short span of time, from using their credit cards and not being able to pay the bill in full by the due date.

Because many consumers do not use credit cards wisely — which more often than not is a result of ignorance — and end up carrying a balance that accrues exorbitant interest amounts and fees, many alleged financial literacy gurus speak negatively about credit cards and encourage consumers to perform “plastic surgery” on them. This they claim means that you should cut up your credit cards so you wouldn’t be able to use them anymore.

Some of them also implore consumers to avoid having more than one credit card because having more than one card is very dangerous, instead of providing financial education about the incredible benefits that the proper use of credit cards can provide.

I believe some of the common benefits of a credit cards are known to you plus I already mentioned some above when I shared why some people have a love-relationship with them. However, most people are either unaware or they downplay some of the greatest benefits of a credit card.

Credit cards are one of the greatest inventions and in addition to the benefits mentioned above, there are three key reasons why I believe that they are super powerful which are:

- You get to use money interest-free for at least 21 days each month providing you do not carry a balance and you pay your bill in full by the due date

- From time to time you get very low promotional interest rates on balance transfers and purchases

- You’re not liable for fraudulent use of your credit card which is very different when compares to debit cards.

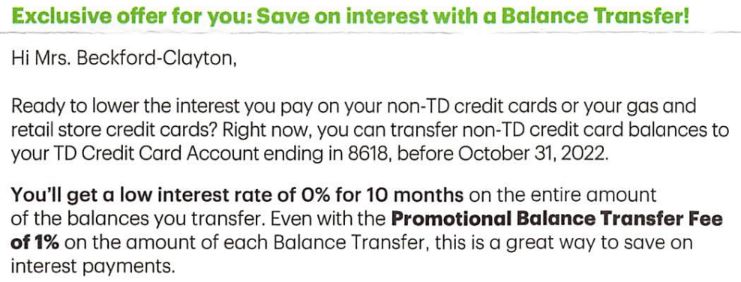

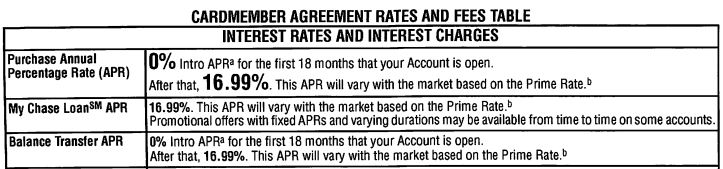

For instance, just this week my husband and I received letters from 2 different Canadian banks with different interest rate promotions on balance transfers on 2 of our existing credit cards. I shared snippets with you in the images below. The third image is a snip from the terms and agreement of a new credit card that I applied for in the United States.

Bank #1

Bank #2

From a US credit card agreement

fromWhile the offers on the existing credit cards are great, do keep in mind that they are more beneficial to you when your card balance is 0. If there are any balance on the card at the time of the balance transfer, any payments that are made to the card will be applied to the balance with the lower interest rate first, and then to the balance with the higer interest rate only when the lower interest rate balance is down to 0.

This is why it is beneficial to have at least 2 credit cards, especially when you carry a balance. One emergency card for unexpected large expenses — on which you aim to maintain a balance of 0 — and the other to use for regular purchases.

But Why?

If you carry a balance on your regular credit card and you have an unexpected large expense that you’re not able to cover, you can put that expense on the emergency card — assuming the balance is 0 — to capitalize on the no-interest grace period which is usually at least 21 days.

Thereafter you can move the balance to a line of credit with a much lower interest rate so that your emergency card is back to 0. And thus, capitalize on low promotional interest on balance transfers on this card, transferring the balance from the card with the higher interest rate to the one with the 0 balance.

However, If you put that expense on the credit card with a balance, you will not get a no-interest grace period for that large sum of money. Interest will start to accrue on the day of the purchase and keeps compounding until all your balance is paid off.

Moreover, you wouldn’t be able to utilize any low-interest balance transfer promotion on your regular card that already has the amount that you want to pay lower interest on.

In the early 2000s when 1-year GICs had interest rates of 5% and 6%, whenever I received promotions like these, I would take the money from my credit cards and buy 1-year GICs. At the end of the year, I would surrender the GICs, repay the loan, then pocket the interest. That was infinite ROI because I gained interest from money that was never mine.

Something else that you could do with the 0% promotional interest rate offer is make mortgage prepayment to reduce your overall mortgage interest. But do ensure that you’re able to pay off the prepayment amount before the interest promotion time is up.

It is important that you gather more information and do your due diligence on the effective use of credit cards and maximizing the benefits of low promotional interest on balance transfers before you use them.

While low-interest balance transfers can save on interest payments, do keep in mind that the purpose of the bank is to make as much interest as possible off you, and not to save you from paying interest, so there’s always a catch!

So try not to get caught!😂