When many of us think about retirement income, some of the first things that come to mind are:

- Pension

- Retirement Savings Plan

- Canada Pension Plan (CPP)

- Traditional Investments (Savings, Stocks & Bonds, Mutual/Portfolio Funds etc.)

- Real Estate Investments

- Downsizing (to get the equity in primary home)

- Tax-Free Savings Account (TFSA)

All of the income from #1-5 from the list about attract taxes.

While #6 doesn’t attract any taxes, it requires you to leave the home that you have lived in for numerous years, leaving priceless memories with your family, friends, and neighbors behind.

Your children may have grown up in this home and love visiting their rooms whenever they come home to visit. Your grandchildren may even love sleeping in their parent’s room whenever they have sleepovers at their grandparents. So you wish to keep the home for much longer and keep cherishing the memories, but you have no choice but to move to access your equity because your retirement income limits your preferred lifestyle and your vacation preferences.

While #7 presents another opportunity to save Tax-Free for retirement, there are limitations with this account. The TFSA was introduced in 2009, so this year will mark the 14th year that you can contribute since it’s inception. Yet, the total contribution room from 2009 to 2022 is only $81,500.

Additionally, because the TFSA is a government-registered account, there are restrictions as to how you can invest the funds in this account. These restrictions limit the potential growth that could be realized compared to investing your money elsewhere, like in real estate, for instance.

Moreover, the maximum contribution in a TFSA for the last 4 years has been $6,000 per year. Let’s assume you have 20 more years to retire. If you make the maximum contribution of $6,000 each year for the next 20 years, assuming you’ll make the maximum contribution of $81,500 by the end of this year, by the time you retire in the year 2042, your total maximum contribution will be $201,500 ($81,500 + $120,000).

I’m going to be generous and give you 100% on your total contribution. So by the year 2043 when you start to withdraw money to supplement your retirement income, your TFSA account would be $403,000.

For simplicity, lets assume the $403,000 is the amount to supplement your retirement for the next year. Each year you will receive $403,000/20 = $20,150.

So, after saving $201,500 for 34 years and doubling your investment, if you live another 20 years after retirement, that will give you less than $2,000 ($20,150/12 = $1679.17) extra per month to supplement your income.

Would you say that’s a Great gain?

Now, consider this next situation that utilizes a Preferred Retirement Solution strategy. This is an investment strategy that involves purchasing a Whole Life Insurance policy on yourself or your children and borrowing against the cash value of the insurance (taking a collateral loan) later to supplement your retirement income.

Of course, loans do not attract taxes and the BEST part is this loan doesn’t have to be repaid because the death benefit will repay the loan when the life insured dies, and the balance is given to your beneficiary as a financial legacy.

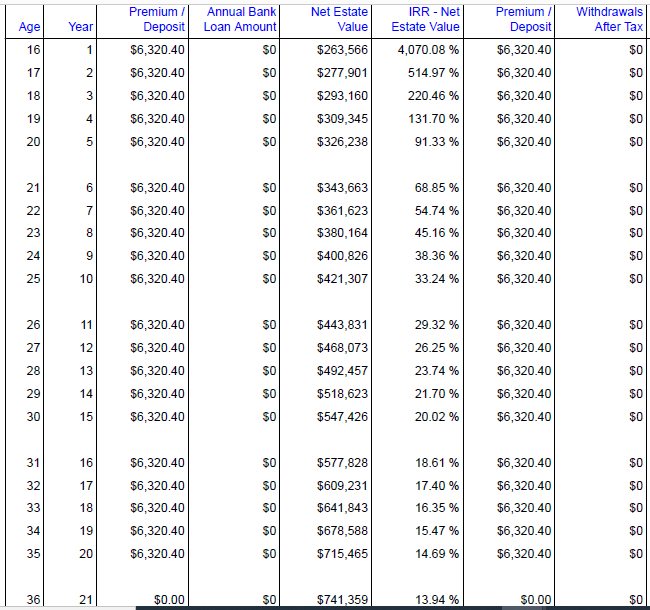

Below is an illustration (I did for a friend) of an example of purchasing a $250K (20-pay) Whole Life Insurance policy on a 15-year-old male child, that uses the Preferred Retirement Solution strategy.

You will see from the illustration that the annual premium is $6,320. Hence, the total payment in premium after 20 years would be $126,400 ($6,320 x 20).

If you look at the Net Estate Value column, you will notice that the value of the estate by the end of the 20th payment is $715,465. At that time the child will be only 35 years old.

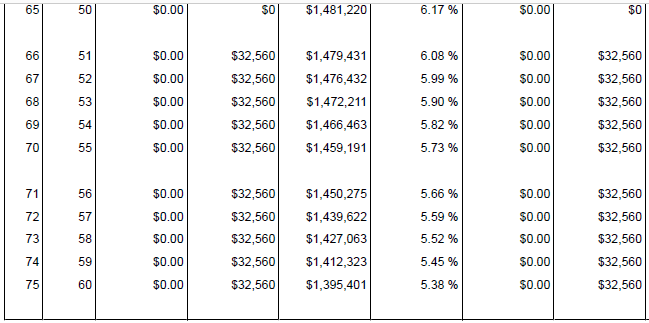

If the policy is not surrendered, the illustration below shows that at age 65 (common retirement age), the child will have a Net Estate Value of $1,481,220. And with that estate value the child can take a loan that gives him $32,560 per year for the next 20 years.

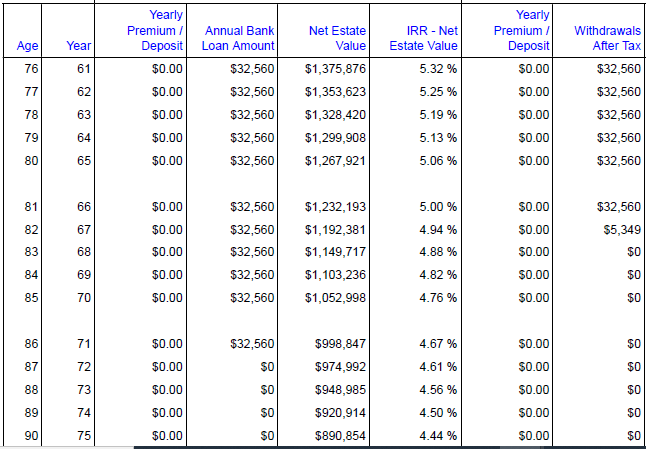

You will also notice that the Net Estate Value keeps decreasing with each $32,560 payout, but in the next snip you will see that after the last payment of $32,560 is taken — when the child is 86 years old, the Net Estate Value is still $974,992 which is a significant amount of money to pass on to his beneficiary when he dies.

Surely you can see that $126,400 can go much further using Preferred Retirement Solution strategy than dumping that money in a TFSA.

And the BONUS is, the Preferred Retirement Solution doesn’t just give you tax-free money to supplement your retirement income. It also allows you to pass on a financial strategy and a significant amount of dough as a legacy for your next generation!

Do you think that it is time for you to reconsider your retirement saving strategy? I hope so!